Financial Literacy, Illuminated.

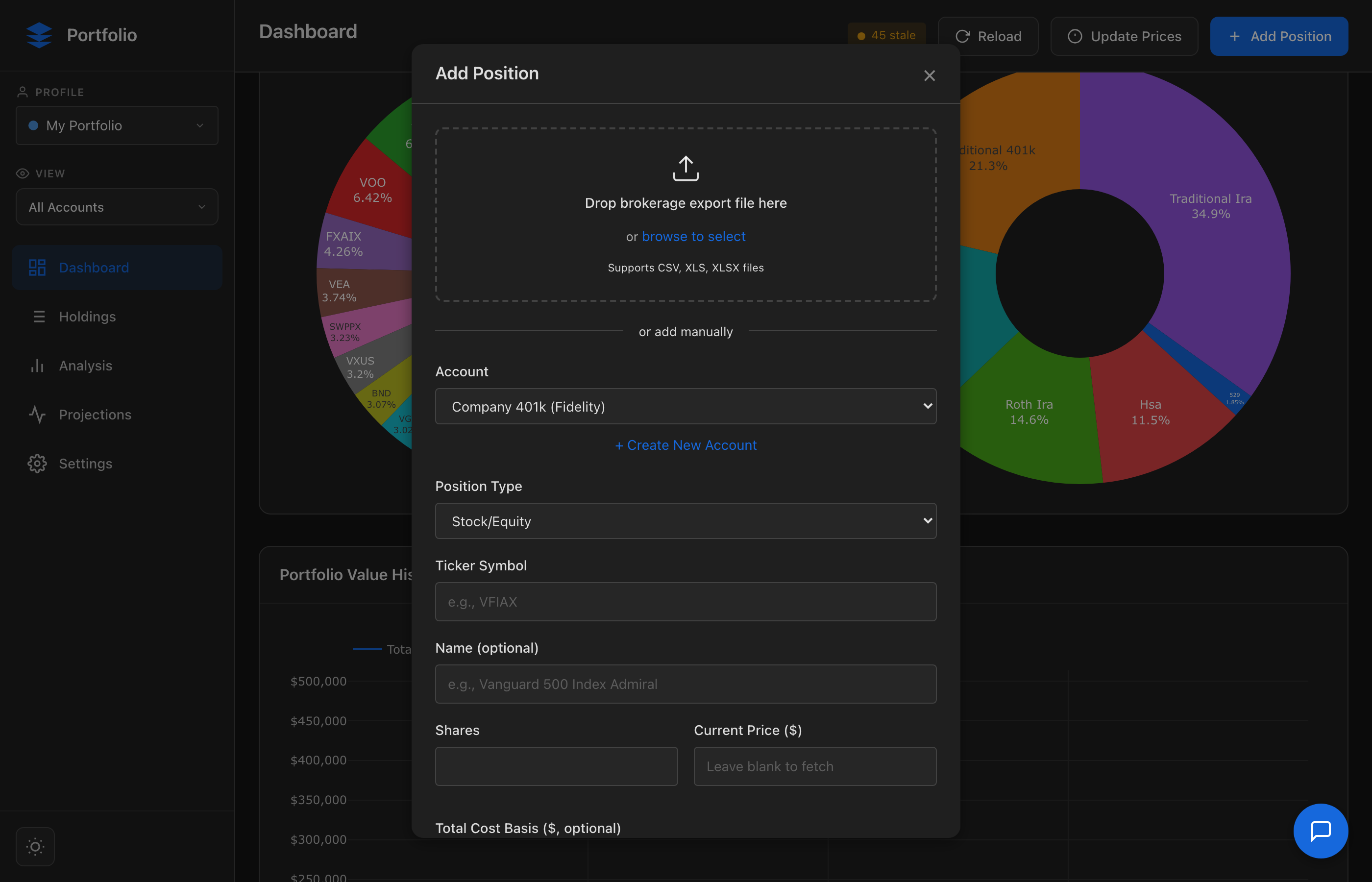

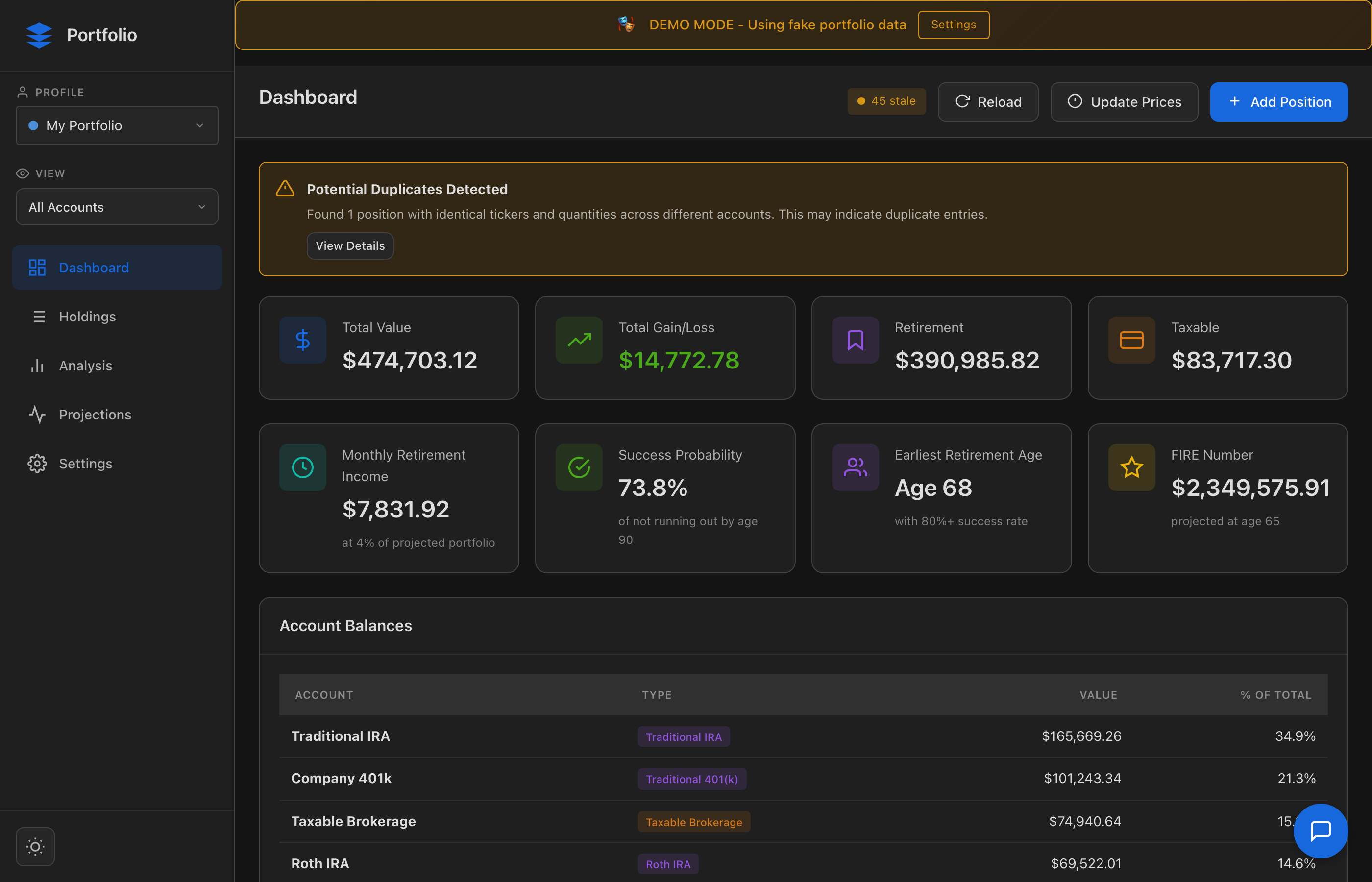

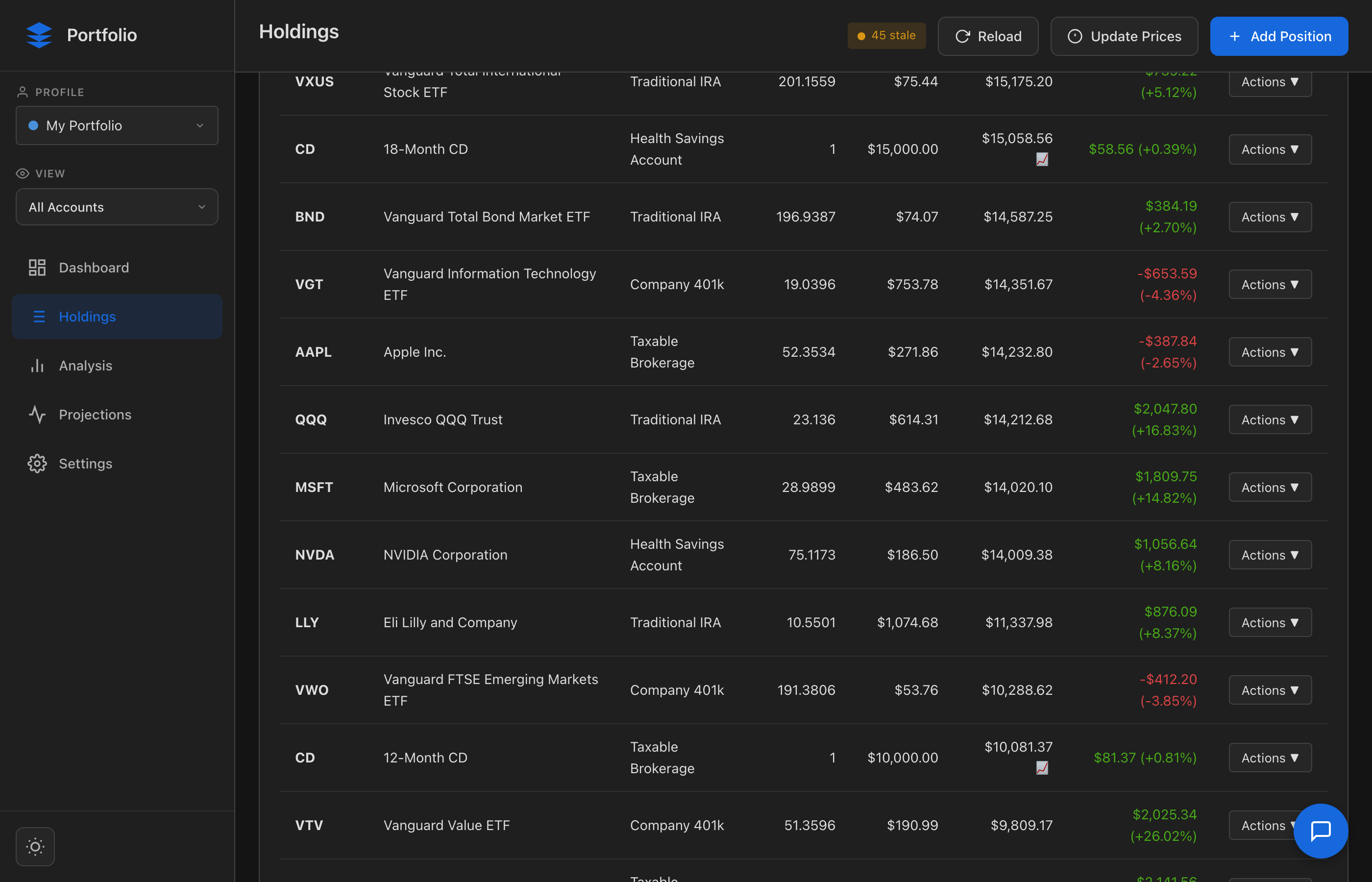

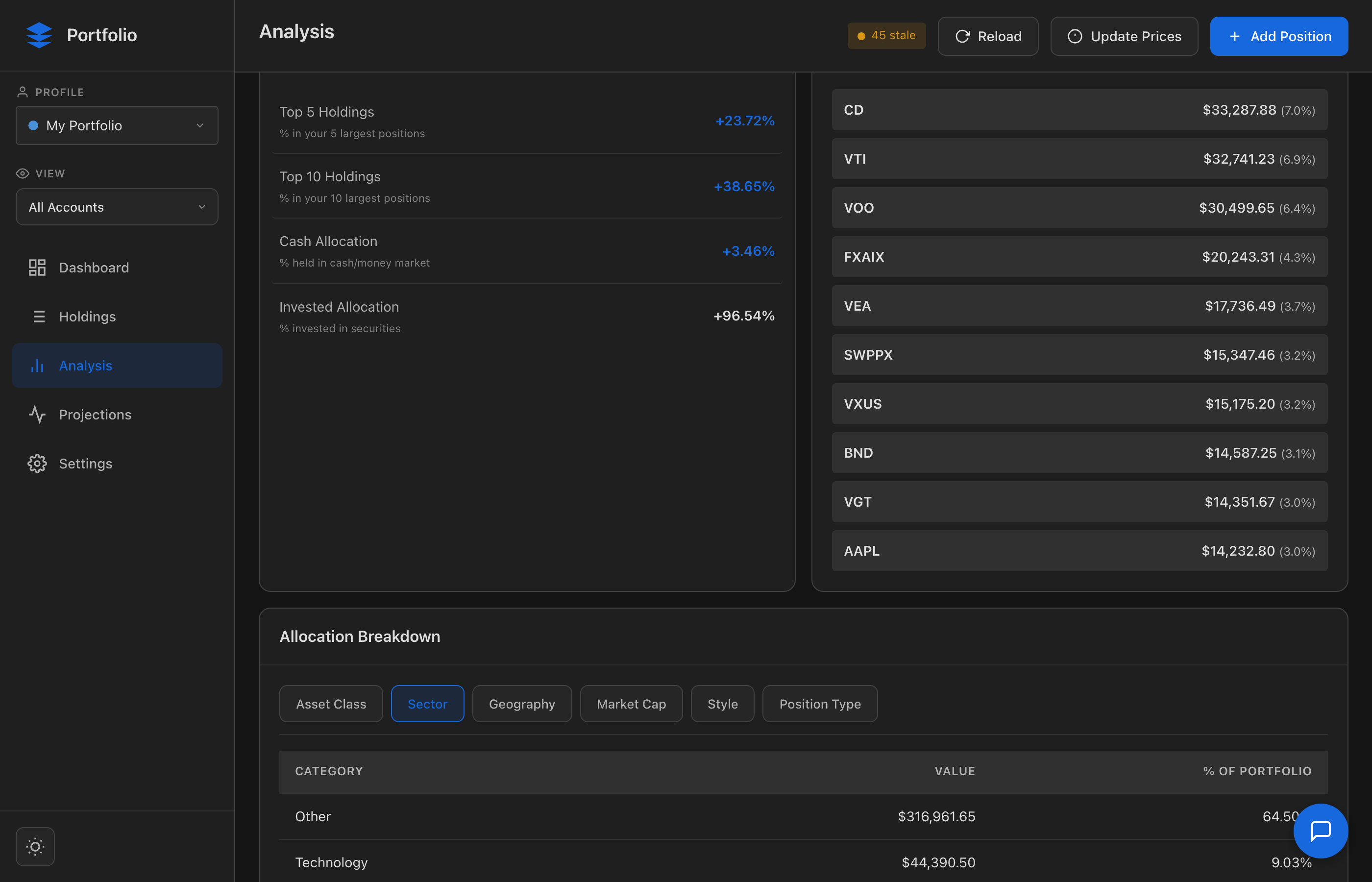

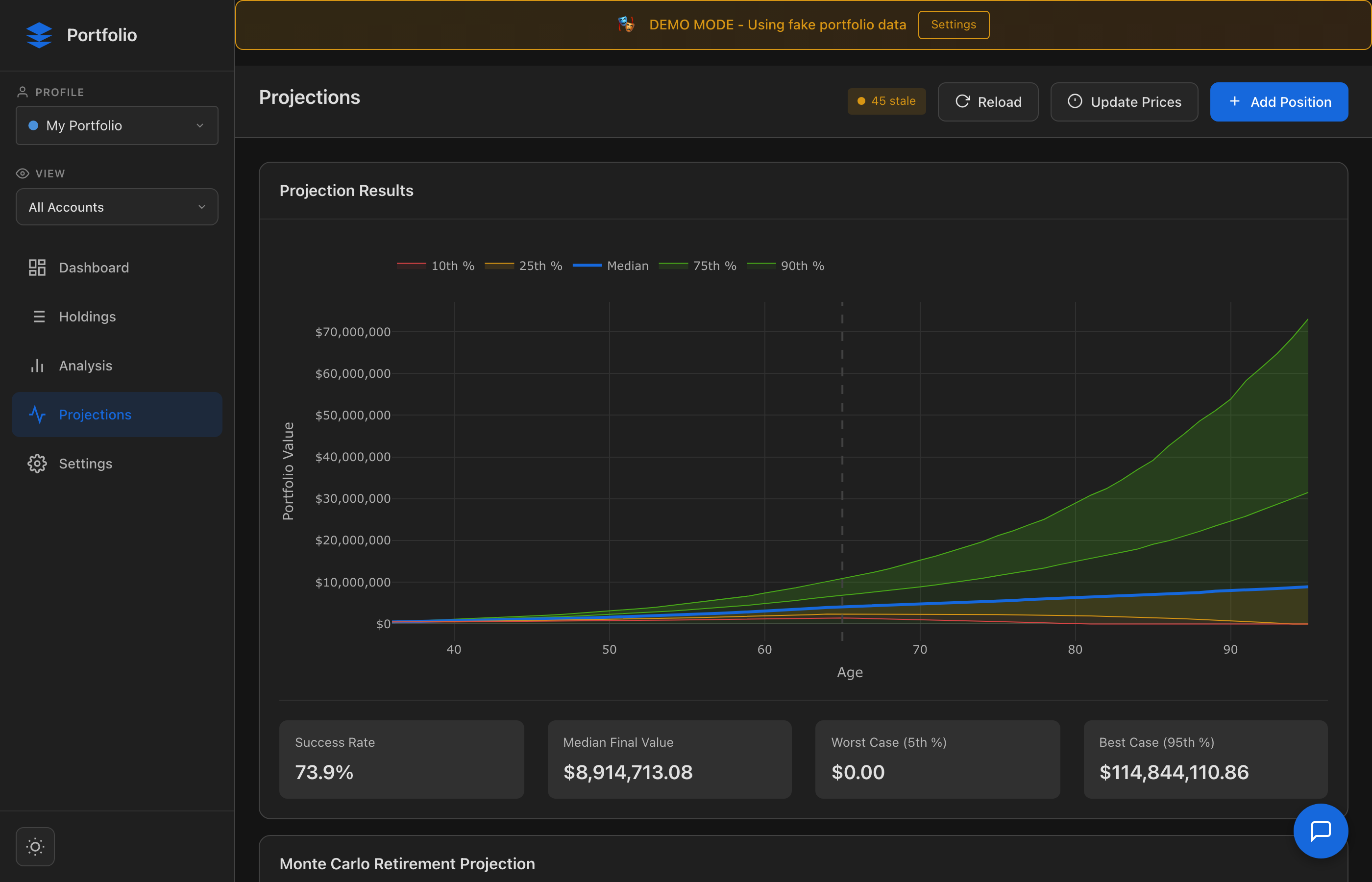

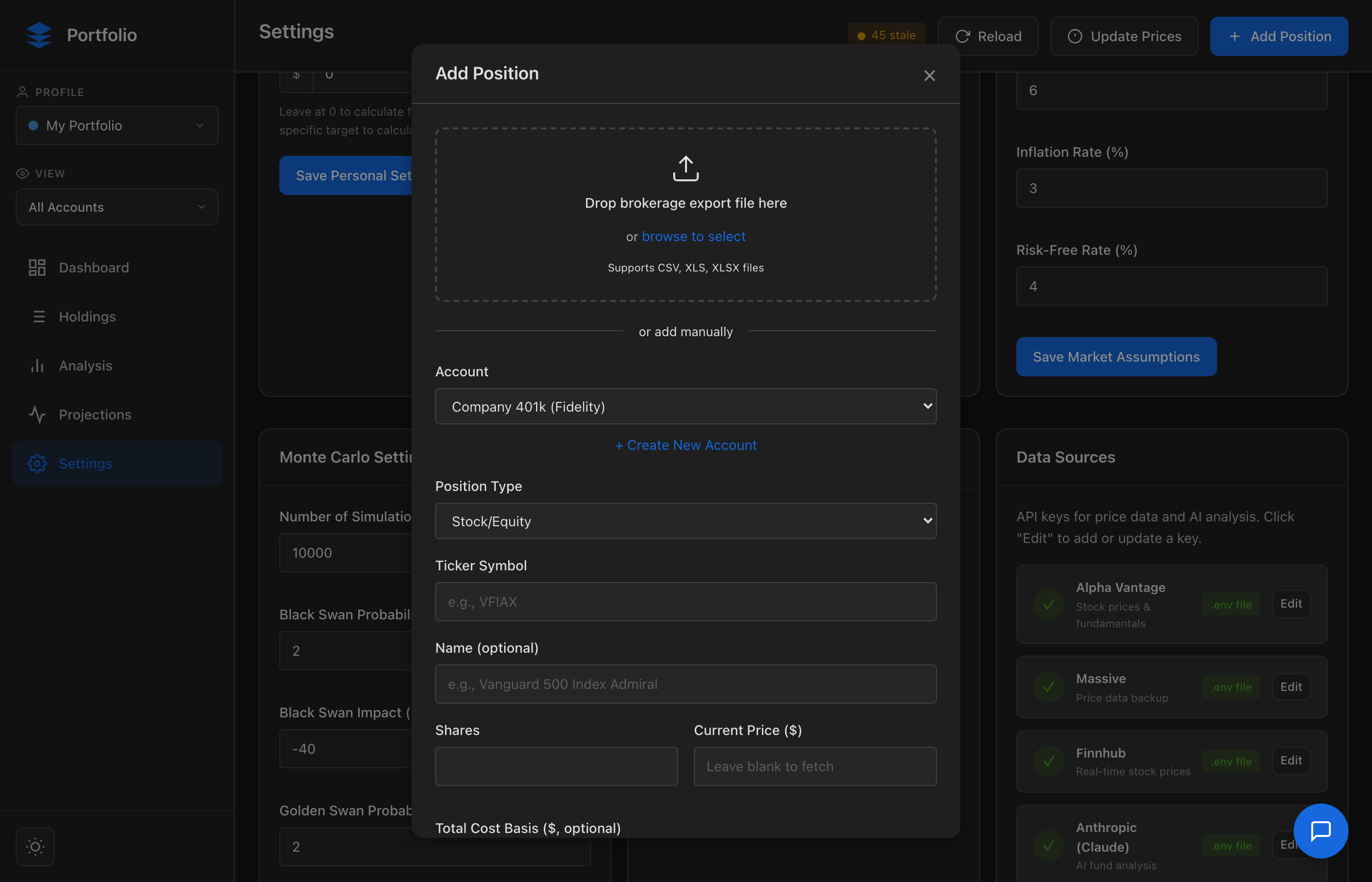

Stop guessing. Start projecting. A powerful, privacy-first portfolio tracker with Monte Carlo retirement simulations, risk analysis, and intelligent allocation insights. The dashboard that answers: "Will my money last?"